top of page

All Posts

Why 90% of Entrepreneurs Fail to Scale

And what finance leaders are still underestimating Most founders do not fail because their product is weak. They fail because the architecture beneath their growth is fragile. After more than three decades working across startups, scale-ups, stagnation phases, crisis situations and exits, I have seen the same pattern repeat itself. The market often rewards momentum in the short term. But it rewards structure in the long term. And structure is where most scaling journeys quiet

mt4656

Feb 125 min read

Capital Allocation: The Discipline That Separates Real Businesses From Noise

Most companies do not fail because they lack ideas. They fail because they misallocate capital . That sentence alone explains the collapse of thousands of businesses that looked promising, innovative, even profitable - right up until they weren’t. Capital allocation is rarely glamorous. It does not trend on social media. It does not win pitch competitions. Yet it is the single discipline that determines whether a business compounds quietly over decades or burns brightly befor

mt4656

Jan 174 min read

Mergers and Acquisitions Don’t Buy Growth. They Buy Complexity

Why most acquisitions fail long after the deal is “successful” By Matteo Turi There is a quiet moment after every acquisition. The contracts are signed. The photos are taken. The press release is published. The board congratulates itself. And then very quietly the business begins to change. Not in dramatic ways. Not in visible ways. But in structural ways. Cash moves differently. Decisions take longer. Customers feel friction. Managers disengage. Systems stop talking to each

mt4656

Jan 123 min read

Why Cash Flow Is King — And Why Profitable Businesses Still Collapse

By Matteo Turi There is a dangerous assumption quietly embedded in modern entrepreneurship: that if a business is profitable, it is safe. It is not. Some of the most painful corporate failures of the last decade did not happen in decline. They happened during expansion. During hiring. During internationalisation. During moments when everything appeared to be “working”. They happened because something far more fundamental than revenue was neglected. Cash. Not the number printe

mt4656

Jan 113 min read

Businesses Don’t Fail Randomly. They Fail Predictably.

By Matteo Turi Why most business collapses are not accidents — and what no one teaches founders about surviving success. Introduction After nearly three decades working inside boardrooms, restructurings, acquisitions and scale-ups across multiple countries and industries, I began to notice something uncomfortable. Businesses were not failing randomly. They were failing in patterns. Different founders. Different technologies. Different markets. Same financial outcomes. Some we

mt4656

Jan 103 min read

Why Profitable Businesses Still Fail

The hidden financial blind spots that quietly destroy great companies By Matteo Turi Some businesses fail suddenly. Others don’t fail at all, at least not on paper. They keep trading. They show profit. They look “fine” from the outside. And then one day, they are gone. After nearly three decades working across boardrooms, turnarounds, scale-ups, and restructurings, I have learned something uncomfortable: most business failures are not caused by a lack of revenue, ambition, or

mt4656

Jan 94 min read

The Hospital Bed That Should Have Made Its Founder a Billionaire

How one pricing decision quietly decides whether your business creates revenue… or real wealth There are moments in business when the difference between a good company and a generational company is decided silently. No press release. No boardroom drama. No public failure. Just a single pricing decision. I want to tell you about a hospital bed that could have built a valuation empire. Instead, it became a cautionary tale. The bed that saved hospitals millions A medical technol

mt4656

Jan 73 min read

How to Think Like a CFO (Without Losing Your Founder Identity)

Founders are taught to lead with vision. Think bigger. Move faster. Push beyond what exists. And in the early stages, that mindset works. Vision creates momentum. Momentum attracts customers. Customers validate ideas. But then something changes. Growth becomes heavier. Decisions carry more weight. Cash feels tighter, even as revenue increases. At this point, many founders feel resistance building inside the business. Not because the idea is wrong, but because the structure un

mt4656

Jan 64 min read

Most Founders Plan Exits Too Late - And why that single mistake quietly destroys valuation

There is a moment many founders remember clearly. The business is finally working. Revenue is growing. The team is in place. Customers are happy. And somewhere in the back of the mind, a thought appears: “One day, this could be worth something.” That is usually when founders start thinking about exits. Unfortunately, that is also when it is often too late. Because exits do not reward effort. They reward transferable value . And transferable value is not built at the end of th

mt4656

Jan 54 min read

AI Is the New Electricity. Most Companies Have No Grid

When electricity was first introduced into cities, it did not immediately change the world. Lightbulbs appeared first. Then machines. Then entire systems of production, transport, healthcare, and communication were rebuilt around electrical power. Electricity did not transform society because it was powerful. It transformed society because people built the grid. Artificial intelligence is now at the same point. We can feel the power. We can see the glow. But most businesses a

mt4656

Jan 34 min read

The Global Trap: When International Expansion Destroys Value Instead of Creating It

Going global is one of the most seductive ideas in business. New markets. New customers. A bigger story. International expansion feels like progress. Often, it is. But I have seen many strong businesses lose value not because they failed abroad, but because they expanded before they were structurally ready. Global ambition is not the problem. Timing is. Growth and Expansion Are Not the Same Thing Founders often equate expansion with growth. In reality, expansion increases com

mt4656

Jan 22 min read

2026 Will Not Reward Hustle. It Will Reward Architecture.

For the past decade, business culture has celebrated speed, grind, and execution. Build fast. Scale fast. Raise fast. But behind the scenes, something very different has been happening. High-growth companies are quietly collapsing. Fundraising is becoming harder, not easier. Valuations feel inconsistent and fragile. Exits are being delayed, repriced, or abandoned entirely. And the pattern is now impossible to ignore. Businesses are not failing because founders lack effort. Th

mt4656

Dec 30, 20253 min read

Capital Stack Confusion: When Funding Decisions Quietly Destroy Optionality

There is a moment in many growing companies when funding feels like progress. Money arrives. The runway extends. Pressure eases. And yet, something important has just been given away. Not always equity. Sometimes control. Sometimes flexibility. Sometimes the future. Capital stack confusion rarely feels dangerous at the time. It feels like relief. That is why it is so costly. When Capital Becomes a Patch Instead of a Strategy Early funding decisions are often made under urgenc

mt4656

Dec 29, 20253 min read

Why Investors Do Not Believe Your Numbers (Even When They Like Your Story)

Many founders leave investor meetings with a strange feeling. The conversation was positive. The questions were engaged. The market interest was clear. And yet, nothing happens afterwards. No term sheet. No follow-up. No momentum. The story seemed compelling. So why the hesitation? In most cases, the answer is not the idea. It is the numbers behind it . A Truth Investors Rarely Say Out Loud Investors are rarely looking for perfection. They are looking for credibility . They w

mt4656

Dec 24, 20253 min read

The Governance Gaps That Quietly Destroy High-Potential Companies

Most companies do not fail because of bad ideas. They fail because the structure beneath those ideas could not carry the weight of growth. Governance is rarely the headline problem. It is the silent one. By the time it becomes visible, the damage is usually already done. Why Governance Feels Optional Until It Isn’t Founders often associate governance with large companies. Public firms. Heavily regulated sectors. Slow, bureaucratic organisations. So in early and mid-stage busi

mt4656

Dec 24, 20253 min read

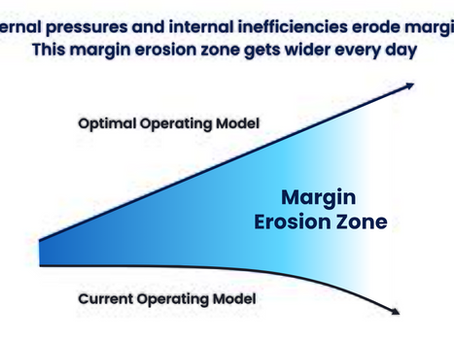

The Margin Mirage: When Growth Masks the Slow Erosion of Value

There is a moment many founders recognise — often too late. The company is busy. Revenue is rising. The team is stretched. Customers are coming in. And yet, something feels wrong. Despite the activity, the reward feels thinner. Despite the effort, the outcome feels muted. Despite growth, value isn’t accumulating as expected. This is not failure. It is something more subtle — and far more dangerous. It is the margin mirage : the illusion that growth automatically protects prof

mt4656

Dec 22, 20254 min read

When Sales Go Up and Cash Goes Down: The Hidden Growth Trap That Destroys Value

One of the most disorienting moments for a founder is this: Sales are rising. The pipeline looks healthy. Customers are buying. The team is expanding. And yet, the bank balance is moving in the wrong direction. Not slowly. Decisively. What begins as confusion often turns into anxiety — and then into silence. Because nothing is obviously “wrong”. And yet something clearly is. This is not poor management. It is not a lack of ambition. And it is not a rare situation. It is one o

mt4656

Dec 18, 20254 min read

The Numbers You Don’t See Are the Ones That Break Companies

There is a moment I have witnessed countless times in boardrooms. It usually comes after a confident presentation. Revenue is growing. The pipeline looks strong. Customers are engaged. The story makes sense. And yet, something feels off. The founder pauses. The CEO leans back. Someone asks a simple question: “How long can we sustain this if conditions change?” Silence follows. Not because the answer is negative —but because no one truly knows. This is not a failure of intelli

mt4656

Dec 17, 20254 min read

The System Debt Crisis: Why Companies Break Long Before Anyone Notices

How invisible operational debt accumulates quietly — and then erupts all at once Introduction Most founders expect financial debt. They fear cashflow gaps, loan obligations, investor pressure, and banking constraints. But the debt that destroys companies is almost never financial. It is system debt — the silent accumulation of operational, structural, and strategic shortcuts that sit beneath a business until one day they don’t. System debt does not appear on a balance sheet.

mt4656

Dec 12, 20255 min read

Why Companies Break at the Same Point: The Hidden Threshold Every Business Crosses Without Realising It

How structural strain, not market conditions, determines whether a company evolves or collapses Introduction Every company reaches a moment that feels strangely familiar: Sales are healthy, demand is real, the team is growing, and the vision feels more achievable than ever. Yet behind the scenes, pressure mounts, decisions slow, complexity rises, and what once felt clear suddenly becomes fragile. This moment is not random, nor is it unique. I’ve watched it appear in family-ru

mt4656

Dec 11, 20254 min read

bottom of page